An analysis of the most prestigious locations for high-end real estate purchases.

Since the beginning of 2024, we have been witnessing an unprecedented migration of individuals with investable assets worth over one million dollars (HNW individuals). According to data from Henley & Partners, 128,000 hight-net-worth individuals changed their primary residence over the past year, with projections indicating this number will reach 135,000 in 2025. Full relocations, vacation home purchases, choosing a second primary residence—the options are many, and the motivations behind them even more so. In this article, we explore where and why the wealthy are investing today.

Cities of the Wealthy

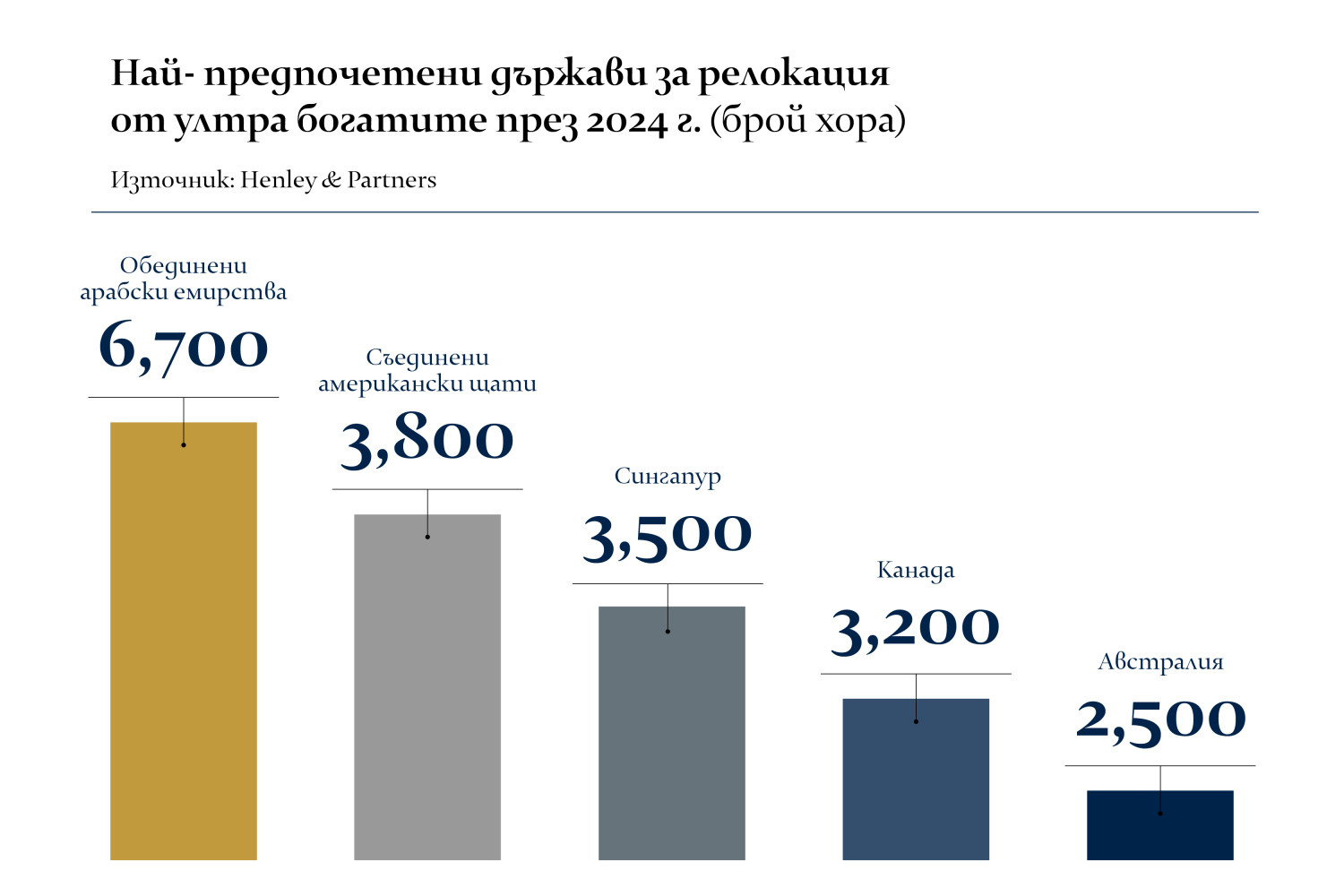

According to the Henley Private Wealth Migration Report, the top destinations for this group include the United Arab Emirates, the United States, Singapore, Canada, and Australia. Key factors influencing their decisions include favorable tax regimes, economic stability, and access to international markets. In Europe, the United Kingdom still hosts the highest number of HNW individuals, followed by France, Germany, and Italy. At the same time, London sees the highest number of millionaires leaving in search of better living conditions elsewhere, most often relocating to the UAE.

Globally, the United States remains home to the largest number of hight-net-worth individuals, primarily concentrated in New York, followed by San Francisco and Los Angeles.

Quo Vadis?

In the past year, 6,700 hight-net-worth individuals relocated to the UAE. The U.S. attracted another 3,800 millionaires, and Singapore ranks third with 3,500. Within Europe, those seeking new opportunities favored Italy (2,200 individuals), Switzerland (1,500), and Greece (1,200 millionaires relocated there last year).

When it comes to luxury real estate purchases, more than 100 properties priced at $10 million or higher were sold in Dubai in just the first half of last year—an increase of 19% compared to the same period in 2023. The ability to obtain a golden visa, low taxation, safety, excellent climate, and a luxurious lifestyle are among the key factors driving investment in the Emirates.

Despite a significant outflow of hight-net-worth individuals from the UK, the country remains a magnet for millionaires from around the world. In spite of rising crime rates in London and the aftermath of Brexit, affluent buyers—primarily from the U.S. and the UAE—continue to invest in ultra-luxury properties across the UK.

In the U.S., the appetite of wealthy investors is increasingly shifting toward Florida. The lack of income tax, favorable climate, and variety of leisure and entertainment options are among the reasons driving interest in luxury property purchases.

In 2024, Canada’s luxury real estate market demonstrated remarkable stability. According to Sotheby’s International Realty Canada and their Top-Tier Real Estate: Fall 2024 State of Luxury Report, published in October 2024, the luxury condo markets in Toronto and Vancouver are becoming more buyer-friendly, with prices stabilizing due to increased inventory.

Key factors making Canada a preferred destination for luxury property investment include its stable banking system, abundant natural resources, and vast areas with potential for future development.

Where Is Bulgaria on the Luxury Real Estate Map?

Interest in investing in luxury residential property in Bulgaria is also rising compared to the previous year, with the market attracting both domestic and international investors. Key advantages of the country include economic stability and competitive taxation—corporate and personal income tax are only 10%, making Bulgaria one of the most attractive destinations in Europe.

Another important factor is EU membership, which provides free access to the single European market.

Bulgaria offers attractive property prices with high growth potential, ranking among the most competitive real estate markets in terms of price per square meter. Leading urban and resort locations offer rental yields of up to 5% annually, making the local market strategically appealing for both local and international investors.

The Bulgarian market is increasingly offering opportunities for investment in new developments, which for many represent the ideal balance between risk and high return. Investing during the construction phase allows for capital gains upon project completion, and there is a growing number of energy-efficient and sustainable buildings, meeting the increasing demand for smart homes.

Modern construction offers lower operating costs and higher liquidity, ensuring a better return on the initial investment.

More and more developers are also offering the popular international option of property customization—allowing spaces to be adapted to the individual needs of the investor.

Investing in new developments in Bulgaria offers stability, high yields, and long-term capital growth. Thanks to the favorable tax environment, growing market, and steady demand, the country remains a top choice for strategic investors.

Choosing the right destination and specific luxury property for investment is a complex decision involving many factors. If you are interested in investing in high-end real estate in Bulgaria or abroad, contact the qualified professionals at Bulgaria Sotheby’s International Realty for more information and a detailed consultation tailored to your investment goals.